As Startup funding in emerging markets takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Startup funding is crucial for the success of new businesses, especially in emerging markets where unique challenges and opportunities abound. In this discussion, we delve into the intricacies of securing funding in these dynamic environments.

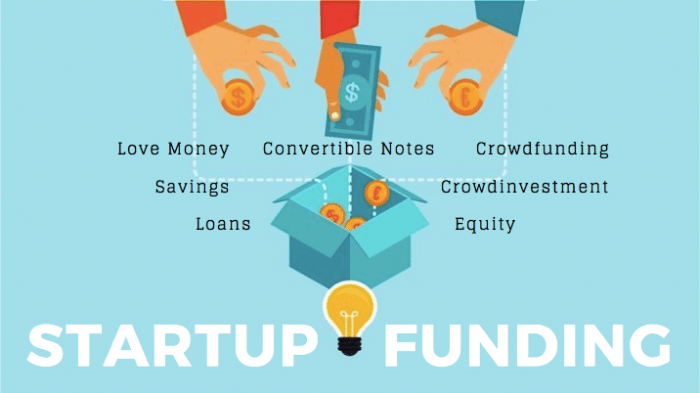

STARTUP FUNDING

Startup funding refers to the financial support that new businesses require to launch, operate, and grow. Securing adequate funding is crucial for startups to cover initial expenses, invest in resources, and scale their operations.

Common Sources of Startup Funding

- Personal Savings: Many entrepreneurs use their own savings to fund their startup.

- Friends and Family: Startups often receive financial support from friends and family members.

- Angel Investors: Angel investors provide capital in exchange for ownership equity or convertible debt.

- Venture Capital: Venture capitalists invest in startups with high growth potential in exchange for equity.

- Crowdfunding: Startups can raise funds from a large number of individuals through online platforms.

Importance of Securing Adequate Funding for Startups

Securing adequate funding is essential for startups to:

1. Cover initial expenses and operational costs.

2. Hire skilled employees and acquire necessary resources.

3. Scale their operations and reach a larger market.

4. Weather financial challenges and sustain growth.

Challenges Startups Face When Seeking Funding

- Competition: Startups face tough competition for funding from other businesses.

- Risk Perception: Investors may view startups as risky investments due to their early-stage and uncertainty.

- Lack of Track Record: Startups with no proven track record may struggle to attract investors.

- Valuation Issues: Determining the valuation of a startup can be challenging for both founders and investors.

Startup Funding in Emerging Markets

Emerging markets are countries that are in the process of rapid industrialization and experiencing significant economic growth. These markets typically have lower income levels, higher volatility, and less mature financial systems compared to developed countries.

Differences between Startup Funding in Emerging Markets and Established Markets

- Emerging markets often have limited access to traditional funding sources such as venture capital and angel investors, leading to startups relying more on bootstrapping or government grants.

- Regulatory environments in emerging markets can be more complex and less favorable for startups, making it challenging to navigate legal and bureaucratic hurdles.

- Investor appetite for risk may vary in emerging markets, with investors being more cautious due to economic instability and political uncertainties.

Opportunities for Startups in Emerging Markets

- Emerging markets offer a large and untapped consumer base, providing startups with the opportunity to scale quickly and reach a wider audience.

- Lower competition in certain sectors in emerging markets can give startups a competitive advantage and the potential for rapid growth.

- Government initiatives and support programs aimed at fostering entrepreneurship can provide startups with funding and resources to fuel their growth.

Challenges for Startups in Emerging Markets Regarding Funding

- Difficulty in accessing traditional funding sources like venture capital due to risk aversion and lack of investor interest in emerging markets.

- Currency fluctuations and economic instability in emerging markets can impact the availability and cost of funding for startups.

- Lack of infrastructure and support systems for startups, such as incubators and accelerators, can hinder their growth and ability to attract investment.

Sources of Startup Funding

Startup funding can come from various sources, each with its own advantages and requirements. Traditional sources of startup funding include:

Traditional Sources of Startup Funding

- Personal Savings: Many entrepreneurs initially fund their startups using their personal savings.

- Bank Loans: Startups can apply for loans from banks, but this often requires collateral and a good credit score.

- Friends and Family: Some startups receive funding from friends and family members who believe in the business idea.

- Grants: Startups can also apply for grants from government agencies, non-profit organizations, or private foundations.

Alternative Funding Options for Startups

Alternative funding options have emerged in recent years to provide startups with more flexibility in raising capital:

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow startups to raise funds from a large number of individual investors.

- Accelerators and Incubators: These programs provide funding, mentorship, and resources to startups in exchange for equity.

- Revenue-Based Financing: Startups can access capital based on their projected revenue, with repayments tied to future earnings.

Venture Capital Funding vs. Angel Investors

Venture capital funding and angel investors are both popular options for startups seeking investment:

- Venture Capital: Venture capitalists are professional investors who provide funding in exchange for equity. They often invest larger amounts of money in later-stage startups.

- Angel Investors: Angel investors are individuals who invest their own money in early-stage startups. They typically provide smaller amounts of funding and are more hands-on with their investments.

Successful Startups Utilizing Crowdfunding

Crowdfunding has enabled many startups to raise significant amounts of capital from a broad audience. Some successful examples include:

- Oculus VR: The virtual reality company raised over $2.4 million on Kickstarter before being acquired by Facebook for $2 billion.

- Pebble: The smartwatch startup raised over $10 million on Kickstarter, becoming one of the most funded campaigns on the platform.

- Exploding Kittens: This card game project raised over $8.7 million on Kickstarter, breaking records for tabletop game campaigns.

Trends in Startup Funding

Startup funding is constantly evolving, driven by various trends that shape the global landscape. Let’s explore some of the key trends impacting startup funding today.

Impact of Technology on Startup Funding

Technology has revolutionized startup funding, making it more accessible and efficient. Platforms like crowdfunding and online investment portals have democratized the funding process, allowing startups to reach a wider pool of investors.

Shift towards Impact Investing

There is a noticeable shift towards impact investing in startup funding, with investors looking to support ventures that create positive social or environmental change. This trend reflects a growing awareness of the importance of sustainability and social responsibility in business.

Importance of Corporate Venture Capital

Corporate venture capital (CVC) is playing an increasingly significant role in funding startups. Companies are recognizing the value of investing in innovative startups to gain access to new technologies, markets, and talent. This trend highlights the growing collaboration between established corporations and emerging startups.

In conclusion, Startup funding in emerging markets presents a mix of hurdles and breakthroughs for entrepreneurs venturing into these promising landscapes. Navigating the funding landscape requires strategic planning and a keen understanding of the market dynamics, ultimately paving the way for innovation and growth in these evolving economies.

FAQ Section

What are the main differences between startup funding in emerging markets and established markets?

In emerging markets, startups often face challenges related to limited access to traditional funding sources, higher risk perceptions, and regulatory uncertainties compared to established markets.

How can startups in emerging markets overcome funding challenges?

Startups in emerging markets can explore alternative funding options like microloans, grants, or incubator programs tailored to their specific market conditions. Building strong partnerships and networks within the local entrepreneurial ecosystem can also help in securing funding.

What role does government support play in startup funding in emerging markets?

Government support in emerging markets can range from financial incentives and tax breaks to creating conducive regulatory environments that attract investors. Such initiatives can significantly boost startup funding and encourage innovation in these markets.