Starting with Startup funding challenges, this introduction aims to give a compelling overview of the obstacles faced by new businesses in securing financial support. Exploring the various types of funding available and the strategies to navigate these challenges, this topic sheds light on the crucial role funding plays in the growth and success of startups.

Introduction to Startup Funding

Startup funding is the financial support provided to new businesses to help them cover initial costs, scale operations, and fuel growth. It plays a crucial role in the success and sustainability of startups by providing the necessary resources to bring innovative ideas to life.

Types of Startup Funding

- 1. Bootstrapping: Involves funding the business using personal savings or revenue generated by the business itself.

- 2. Angel Investors: High-net-worth individuals who invest their own money in startups in exchange for equity.

- 3. Venture Capital: Investment firms that provide funding to startups in exchange for equity and a stake in the company.

- 4. Crowdfunding: Involves raising small amounts of money from a large number of people, typically through online platforms.

- 5. Accelerators and Incubators: Programs that offer funding, mentorship, and resources to help startups grow and succeed.

Role of Startup Funding in Business Growth

Startup funding is essential for new businesses to survive and thrive in the competitive market landscape. It enables startups to hire talent, develop products, market their offerings, and expand their reach. Without adequate funding, startups may struggle to scale their operations and reach their full potential.

Common Challenges Faced by Startups in Securing Funding

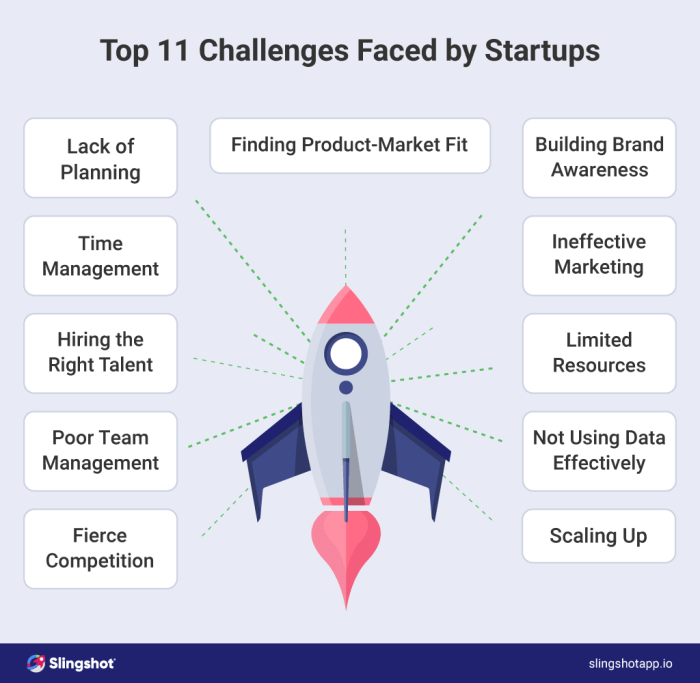

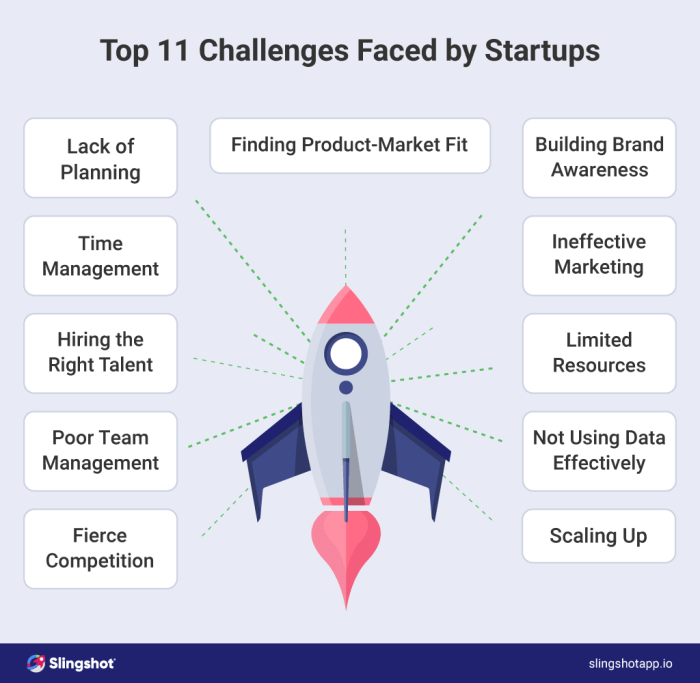

Startups often encounter several challenges when trying to secure funding for their ventures. These obstacles can significantly impact their ability to grow and succeed in the competitive business landscape.

Lack of Collateral or Credit History

One of the major challenges faced by startups is the lack of collateral or credit history. Traditional lenders, such as banks, often require collateral or a strong credit history to provide funding. Startups, especially those in the early stages, may not have these assets to offer as security, making it difficult to secure loans or investment.

Market Volatility and Economic Conditions

Another significant challenge for startups is the impact of market volatility and economic conditions on funding opportunities. Uncertain market conditions can make investors hesitant to commit capital to new and unproven ventures. Economic downturns can also restrict the availability of funding, as investors become more risk-averse and conservative in their investment decisions.

Strategies to Overcome Funding Challenges

When faced with funding challenges, startups can employ various strategies to secure the necessary capital to grow their business. One crucial step is creating a solid business plan that Artikels the company’s goals, target market, financial projections, and competitive analysis. A well-thought-out business plan can attract potential investors and demonstrate the startup’s potential for success.

Importance of Creating a Solid Business Plan

A solid business plan serves as a roadmap for the startup, helping to articulate its vision and strategy to investors. It provides a clear Artikel of the business model, revenue streams, marketing plan, and growth projections. Investors are more likely to fund a startup with a well-crafted business plan that shows a viable path to profitability.

Exploring Alternative Funding Sources

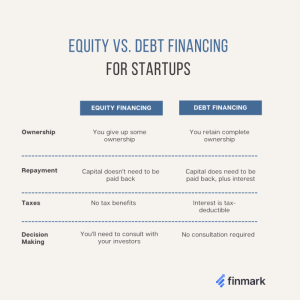

Aside from traditional funding sources like bank loans and grants, startups can explore alternative options such as angel investors, venture capitalists, or crowdfunding platforms. Angel investors are individuals who provide capital in exchange for equity in the company, while venture capitalists are firms that invest in high-growth startups in exchange for equity. Crowdfunding platforms allow startups to raise funds from a large number of individuals who contribute small amounts of money.

Impact of Startup Funding Challenges on Business Growth

Startup funding challenges can significantly impact the growth and success of a business. Without adequate financial resources, startups may struggle to scale their operations, develop new products or services, and reach new markets. This can hinder their ability to compete effectively in the industry and ultimately lead to stagnation or failure.

Relationship between Funding Availability and Scalability

The availability of funding is directly correlated with the scalability of a startup. Adequate capital allows startups to invest in hiring top talent, expanding their infrastructure, and implementing marketing campaigns to reach a wider audience. Without sufficient funds, startups may be limited in their ability to grow and expand, potentially missing out on key opportunities for development.

Successful Navigation of Funding Challenges for Sustained Growth

Successfully overcoming funding challenges is crucial for sustained growth in startups. By securing funding through various sources such as venture capital, angel investors, or crowdfunding, startups can access the resources needed to innovate, pivot when necessary, and capitalize on emerging market trends. This strategic approach to funding can not only ensure short-term survival but also pave the way for long-term success and growth.

Wrapping up the discussion on Startup funding challenges, it’s evident that the ability to overcome financial obstacles is key to achieving sustainable growth for startups. By understanding the common challenges, exploring effective strategies, and leveraging alternative funding sources, businesses can position themselves for long-term success in the competitive market landscape.

FAQ Section

How can startups without collateral secure funding?

Startups without collateral can explore options like angel investors, crowdfunding, or creating a compelling business plan to attract investors.

What impact does market volatility have on startup funding?

Market volatility can make it harder for startups to secure funding as investors may be more cautious, affecting the availability and terms of funding.

Is it necessary to have a credit history for startup funding?

While a good credit history can be beneficial, startups can still secure funding through other means like showcasing a strong business model and potential for growth.