Embark on the journey of understanding Equity vs debt funding for startups, exploring the pivotal choices entrepreneurs face when funding their ventures.

Delve deeper into the nuances of each funding option to make informed decisions that pave the way for startup success.

Equity vs Debt Funding for Startups

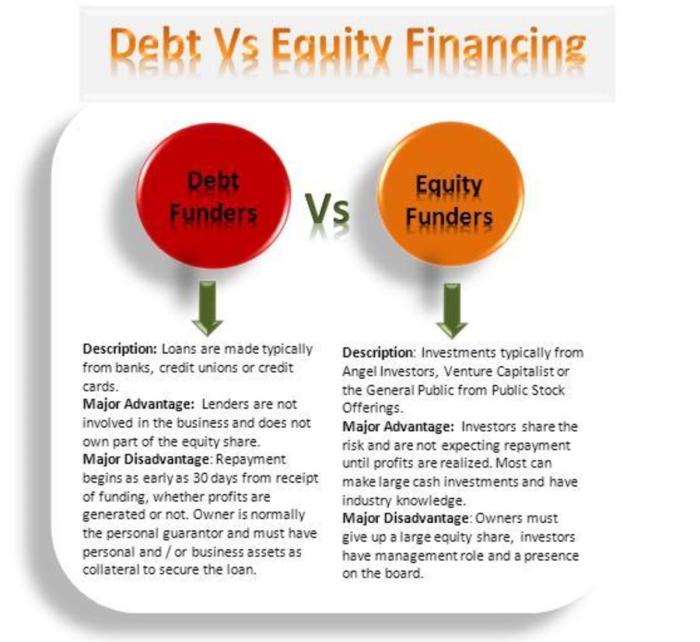

When it comes to funding options for startups, two main choices are equity and debt financing. Each option comes with its own set of pros and cons, which can significantly impact the growth and success of a startup.

Equity Funding for Startups

Equity funding involves selling a portion of the company to investors in exchange for capital. Here are some advantages and disadvantages of equity funding:

- Pros:

- Does not require repayment, reducing financial pressure on the startup.

- Investors share the risks and rewards of the business, providing valuable support and guidance.

- Potential for networking opportunities and connections through investor relationships.

- Cons:

- Loss of control and decision-making power as investors may have a say in the direction of the company.

- Dilution of ownership as more investors come on board with subsequent funding rounds.

- Potential conflicts of interest between founders and investors regarding the company’s goals and strategies.

Debt Funding for Startups

Debt funding involves borrowing money that must be repaid over time with interest. Here are some advantages and disadvantages of debt funding:

- Pros:

- Retain full ownership and control of the company without having to give up equity.

- Interest payments on debt are tax-deductible, reducing the overall cost of capital.

- No interference in business operations from lenders, allowing founders to run the company as they see fit.

- Cons:

- High levels of debt can lead to financial strain and cash flow issues, especially for early-stage startups.

- Risk of default if the company is unable to make timely repayments, potentially leading to bankruptcy.

- Lack of flexibility in repayment terms compared to equity financing, which can hinder growth opportunities.

Equity Funding

Equity funding is a method of raising capital for startups by selling shares of the company to investors in exchange for funds. Unlike debt funding, where the company borrows money and must repay it with interest, equity funding involves giving up ownership stakes in the business.

Types of Investors Involved in Equity Funding

- Venture Capitalists: These are professional investors who provide funding to startups in exchange for equity.

- Angel Investors: Individuals who invest their own money in startups in exchange for ownership.

- Private Equity Firms: Companies that invest in established businesses or startups in exchange for equity.

Impact of Equity Funding on Ownership and Control of the Startup

Equity funding dilutes the ownership of the founders as they give up a portion of their company to investors. The more funding rounds a startup goes through, the more ownership they may have to relinquish. Additionally, investors who hold equity in the company may have a say in decision-making processes, impacting the control that the founders have over the direction of the business.

Debt Funding

When it comes to funding a startup, debt funding is another popular option besides equity funding. Debt funding involves borrowing money that needs to be repaid over a specific period of time with interest. Let’s dive into the process of obtaining debt funding for startups and explore the various forms of debt funding available to them.

Process of Obtaining Debt Funding

- Start by creating a detailed business plan outlining your startup’s goals, revenue projections, and how you plan to utilize the borrowed funds.

- Identify potential lenders such as banks, credit unions, online lenders, or even family and friends who are willing to lend you money.

- Submit a loan application along with necessary documents like financial statements, tax returns, and a personal guarantee if required.

- Wait for the lender to review your application, conduct a credit check, and assess the risk associated with lending to your startup.

- If approved, negotiate loan terms including the interest rate, repayment schedule, and any collateral required to secure the loan.

- Once the terms are agreed upon, sign the loan agreement and receive the funds to use for your startup’s operations or growth.

Forms of Debt Funding for Startups

- Bank Loans: Traditional loans provided by banks with fixed interest rates and repayment terms.

- Line of Credit: A revolving credit line that allows you to borrow funds as needed up to a certain limit.

- Equipment Financing: Loans specifically for purchasing equipment or machinery for your startup.

- Convertible Notes: Short-term loans that can be converted into equity in the future.

Risks of Debt Funding vs. Equity Funding

- Repayment Obligation: With debt funding, startups have a fixed repayment schedule regardless of their financial performance, which can strain cash flow.

- Interest Payments: Startups need to pay interest on the borrowed funds, increasing the overall cost of capital compared to equity funding.

- Collateral Requirement: Some lenders may require collateral to secure the loan, putting startup assets at risk in case of default.

- Risk of Default: Failing to repay a loan can lead to legal consequences and damage the startup’s creditworthiness, making it harder to secure future funding.

Startup Funding

When deciding between equity and debt funding for a startup, there are several key considerations to keep in mind. Equity funding involves giving up ownership of a portion of the company in exchange for capital, while debt funding requires repayment with interest.

Key Considerations

- Assess the financial needs of the startup and determine the amount of funding required.

- Evaluate the risk tolerance of the founders and their willingness to share ownership.

- Consider the stage of the startup and its growth potential when choosing between equity and debt funding.

Successful Startups with Equity Funding

- Uber: Uber raised significant equity funding to support its rapid expansion globally.

- Airbnb: Airbnb utilized equity funding to scale its platform and reach a wider audience.

Preparation for Seeking Funding

- Create a detailed business plan outlining the startup’s goals, target market, and financial projections.

- Build a strong team with relevant expertise and experience to instill confidence in potential investors.

- Network with angel investors, venture capitalists, and other funding sources to explore different funding options.

In conclusion, navigating the realm of startup funding requires careful consideration of the trade-offs between equity and debt financing, ultimately shaping the growth trajectory of new businesses.

Top FAQs

What are the main differences between equity and debt funding?

Equity funding involves giving up ownership stakes in exchange for capital, while debt funding requires repayment with interest.

How does equity funding impact ownership and control of a startup?

Equity funding can dilute the founder’s ownership but also brings strategic partners and investors onboard.

What are the risks associated with debt funding compared to equity funding?

Debt funding comes with the obligation to repay the borrowed amount along with interest, which can strain cash flow, unlike equity funding.