As Top venture capital firms take the spotlight, this captivating introduction invites readers into a world of high-stakes investments and groundbreaking innovations, promising a journey filled with insights and revelations.

Delve into the realm of venture capital and discover the key players shaping the future of entrepreneurship worldwide.

Top Venture Capital Firms

Venture capital firms play a crucial role in the startup ecosystem by providing funding, mentorship, and networking opportunities to early-stage companies. Here are the top 5 venture capital firms globally based on their track record, portfolio companies, and overall impact:

Criteria for Ranking Venture Capital Firms

- Investment track record

- Portfolio company success

- Amount of funds raised and managed

- Network and connections in the industry

- Innovation and adaptability

Significance of Top Venture Capital Firms

- Access to capital for startups

- Mentorship and guidance for founders

- Validation and credibility for portfolio companies

- Ability to attract top talent

- Contribution to innovation and economic growth

Characteristics of successful venture capital firms

Successful venture capital firms share key traits that contribute to their overall success in the industry. These characteristics enable them to identify promising startups, make strategic investments, and ultimately achieve high returns on their investments.

Focus on innovation and disruption

Successful venture capital firms prioritize investing in innovative startups that have the potential to disrupt traditional industries. By backing companies that offer groundbreaking solutions or products, these firms position themselves at the forefront of technological advancements. For example, Sequoia Capital’s early investment in companies like Apple, Google, and Airbnb showcases their focus on disruptive innovation.

Strong network and industry connections

Venture capital firms with strong networks and industry connections have a competitive edge in sourcing deals and providing value to their portfolio companies. These connections allow them to access top-tier entrepreneurs, industry experts, and potential partners. For instance, Andreessen Horowitz’s extensive network has helped their portfolio companies gain visibility and strategic partnerships.

Risk-taking and long-term vision

Successful venture capital firms are willing to take calculated risks on early-stage startups with high growth potential. They understand that not all investments will succeed but maintain a long-term vision for the companies they back. For example, Accel Partners’ investment in Facebook at an early stage exemplifies their risk-taking approach and long-term belief in the company’s success.

Hands-on support and mentorship

Venture capital firms that provide hands-on support and mentorship to their portfolio companies increase the likelihood of success. By offering valuable guidance, resources, and strategic advice, these firms help startups navigate challenges and accelerate their growth. For instance, Bessemer Venture Partners’ team of experienced operators actively engages with their portfolio companies to drive success.

Exit strategy and portfolio diversification

Successful venture capital firms have a clear exit strategy in place to realize returns on their investments. They strategically diversify their portfolio to minimize risks and maximize returns. For example, Benchmark’s disciplined approach to portfolio diversification has led to successful exits through IPOs and acquisitions.

Investment strategies of leading venture capital firms

When it comes to investment strategies, top venture capital firms each have their unique approach that sets them apart from the rest. These strategies are carefully crafted to maximize returns while managing risks effectively in the ever-evolving market.

Sequoia Capital vs. Andreessen Horowitz

Sequoia Capital is known for its conservative approach, focusing on proven business models and experienced founders. On the other hand, Andreessen Horowitz is more willing to take risks on early-stage startups with disruptive potential. Both strategies have their merits, with Sequoia’s approach offering stability and Andreessen’s approach potentially yielding high rewards.

- Sequoia Capital: Invests in later-stage companies with proven track records.

- Andreessen Horowitz: Focuses on early-stage startups with innovative ideas.

Alignment with Market Trends

These investment strategies align with current market trends by adapting to the changing landscape of technology and innovation. Sequoia’s conservative approach ensures a steady flow of returns in established industries, while Andreessen’s willingness to take risks reflects the demand for disruptive ideas in emerging sectors.

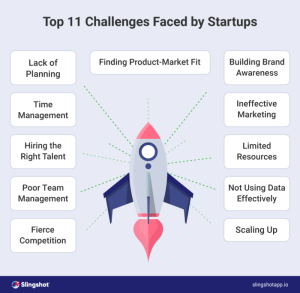

Impact on Startup Funding

The investment strategies of leading venture capital firms have a significant impact on startup funding. Startups that align with the investment focus of these firms are more likely to secure funding and support for their growth. However, startups that do not fit the criteria may struggle to attract investment, highlighting the importance of understanding the preferences of different venture capital firms.

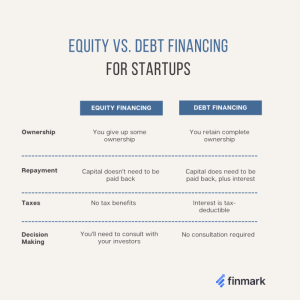

Start-up funding

Startup funding refers to the financial resources required to launch and grow a new business. It plays a crucial role in helping startups cover initial expenses, invest in product development, and scale their operations. Without adequate funding, many startups struggle to survive and reach their full potential.

Different sources of startup funding

- Personal savings: Entrepreneurs can use their own savings to fund their startup, demonstrating confidence in their venture.

- Friends and family: Startups can seek financial support from friends and family members who believe in their vision.

- Angel investors: Angel investors are individuals who provide capital in exchange for equity in the startup.

- Crowdfunding: Startups can raise funds from a large number of individuals through online platforms like Kickstarter and Indiegogo.

- Bank loans: Some startups may qualify for traditional bank loans to finance their operations.

Pros and cons of obtaining funding from venture capital firms

- Pros:

- Venture capital firms can provide substantial funding to fuel rapid growth and expansion.

- They often bring valuable industry expertise, connections, and mentorship to the table.

- Access to venture capital can validate a startup’s potential, attracting further investors.

- Cons:

- Venture capital firms typically require equity in the startup, leading to dilution of ownership for the founders.

- There is pressure to achieve high growth and quick returns on investment, which may not align with the startup’s long-term vision.

- Securing funding from venture capital firms can be competitive and time-consuming, with no guarantee of success.

In conclusion, Top venture capital firms stand as pillars of support for budding startups, driving innovation and growth in the competitive landscape of business. Explore the dynamic world of venture capital and witness the potential for transformative change in the startup ecosystem.

Question & Answer Hub

What criteria are used to rank venture capital firms?

The criteria typically include the firm’s track record, successful investments, fund size, and reputation in the industry.

What are some characteristics of successful venture capital firms?

Successful firms often have a strong network, strategic vision, risk-taking ability, and the capacity to identify promising startups.

How do investment strategies of top venture capital firms align with market trends?

These firms adapt their strategies to capitalize on emerging trends, ensuring they stay ahead of the curve in the dynamic investment landscape.