Embark on a journey through the world of startup funding rounds explained, where we unravel the key stages and essential insights for entrepreneurs seeking financial backing. This exploration promises to be both enlightening and practical, shedding light on the intricacies of securing funding in the competitive startup landscape.

As we delve deeper, we will uncover the nuances of different funding rounds, offering a comprehensive guide for navigating the complexities of fundraising in the startup ecosystem.

STARTUP FUNDING

Startup funding is the financial support provided to new businesses to help them grow and succeed. It plays a crucial role in enabling startups to develop their products or services, expand their operations, and reach their target market.

Types of Startup Funding

- Seed Funding: Seed funding is the initial capital raised by a startup to cover initial expenses such as market research, product development, and prototype creation.

- Venture Capital: Venture capital is funding provided by investors to startups with high growth potential in exchange for equity ownership.

- Angel Investors: Angel investors are individuals who provide financial backing to startups in their early stages in exchange for ownership equity or convertible debt.

Key Factors Influencing Startup Funding

- Market Potential: Investors are more likely to fund startups with a large addressable market and high growth potential.

- Founder’s Expertise: The experience, skills, and track record of the startup’s founders play a significant role in attracting investors.

- Traction: Startups that can demonstrate early customer adoption, revenue growth, and market validation are more likely to secure funding.

- Business Model: A clear and scalable business model that shows potential for profitability is essential for attracting investors.

Startup Funding Rounds Explained

Startup funding rounds are essential for the growth and development of startups as they provide the necessary capital needed to scale operations, develop products, and expand market reach. These rounds involve investors injecting funds into a startup in exchange for equity or ownership stake in the company.

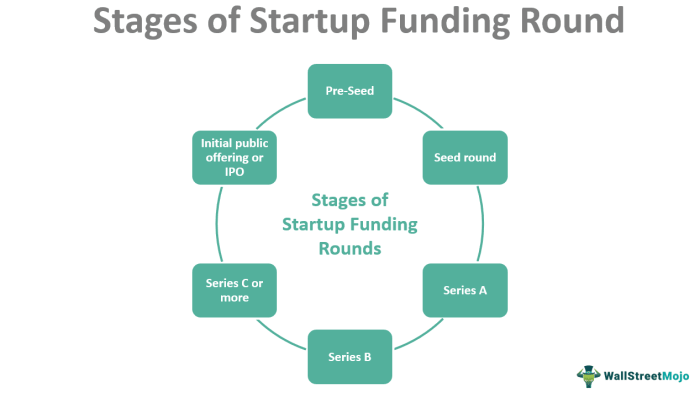

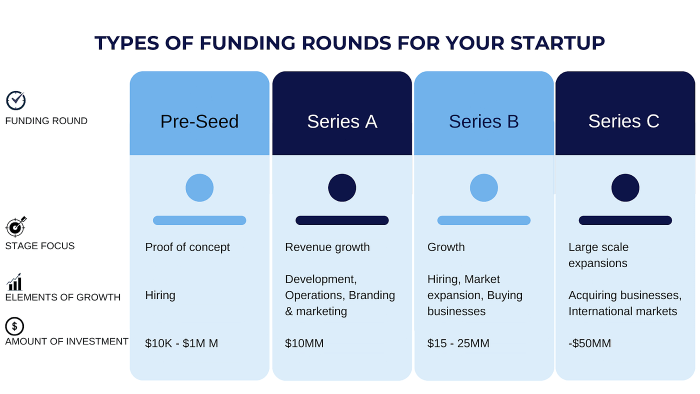

Common Stages of Startup Funding Rounds

Startup funding rounds typically progress through several stages, each with its own characteristics and goals. Here are the common stages:

- Pre-Seed: This initial stage involves raising funds from friends, family, or individual angel investors to validate the startup idea and build a prototype.

- Seed: In the seed stage, startups seek funding to further develop their product, conduct market research, and build a customer base. Seed funding is often provided by angel investors, venture capital firms, or crowdfunding platforms.

- Series A: At this stage, startups have proven their business model and are looking to scale operations. Series A funding is used to expand market reach, hire key personnel, and invest in marketing and sales efforts.

- Series B and Beyond: Series B funding and subsequent rounds are focused on accelerating growth, acquiring competitors, expanding into new markets, or preparing for an IPO. These rounds involve larger investments from venture capital firms or private equity investors.

Seed Funding

Seed funding is the initial capital raised by a startup to cover the early stages of development. This funding is crucial for turning an idea into a viable business and typically ranges from $50,000 to $2 million.

Sources of Seed Funding

- Angel investors: High-net-worth individuals who provide capital in exchange for ownership equity.

- Venture capital firms: Specialized firms that invest in early-stage companies with high growth potential.

- Incubators and accelerators: Programs that provide funding, mentorship, and resources to startups in exchange for equity.

Criteria for Seed Funding

- Strong team: Investors look for founders with relevant experience and a track record of success.

- Market potential: The startup should target a large and growing market with a unique value proposition.

- Prototype or MVP: Having a minimum viable product or prototype demonstrates progress and market validation.

Comparison with Other Funding Rounds

Seed funding is considered the riskiest stage of investment as startups are at an early stage and may not have proven their business model. However, seed funding offers the potential for high returns if the startup succeeds. Compared to later funding rounds like Series A or Series B, seed funding involves higher risk but also the opportunity for early investors to secure a larger share of the company at a lower valuation.

Venture Capital Funding

Venture capital funding is a type of financing provided by venture capital firms or investors to startups and small businesses that have the potential for high growth. Unlike other funding sources like seed funding or angel investors, venture capital funding typically involves larger amounts of capital in exchange for equity in the company.

Securing Venture Capital Funding

Securing venture capital funding involves pitching your business idea to venture capital firms, demonstrating your growth potential, and negotiating the terms of the investment. Venture capitalists often conduct thorough due diligence before investing, assessing the market potential, team capabilities, and scalability of the business.

Expectations with Venture Capital Funding

When securing venture capital funding, startups should be prepared for a more hands-on approach from investors. Venture capitalists often take an active role in guiding the strategic direction of the company, providing industry expertise, and helping with networking opportunities to accelerate growth.

Advantages and Disadvantages

- Advantages: Venture capital funding can provide startups with access to significant capital to fuel rapid growth, expertise and guidance from experienced investors, and valuable connections in the industry.

- Disadvantages: On the flip side, venture capital funding often comes with a loss of control as investors may have a say in major decisions, pressure to achieve high growth targets, and the risk of diluting ownership through multiple funding rounds.

In conclusion, grasping the dynamics of startup funding rounds is crucial for aspiring entrepreneurs looking to propel their ventures to new heights. By understanding the distinct stages and strategies involved, startups can position themselves for success and growth in an ever-evolving market.

FAQ Summary

What are the key stages of startup funding rounds?

The common stages include pre-seed, seed, Series A, Series B, and so on, each with specific characteristics and goals.

How does seed funding differ from other types of startup funding?

Seed funding typically involves smaller investment amounts compared to other rounds and focuses on early-stage startups.

What factors influence a startup’s ability to secure funding?

Factors such as market potential, team expertise, and traction in the market play a crucial role in attracting investors.