Embark on a journey through the intricacies of valuing a startup for funding. From understanding the basics to exploring advanced methods, this guide offers valuable insights for entrepreneurs and investors alike.

Delve into the factors that influence startup valuation, the methods used, and the importance of financial projections in securing funding.

Understanding Startup Funding

Startup funding is the financial support provided to new businesses in order to help them grow and succeed. This funding can come from various sources and plays a crucial role in the development of a startup.

Importance of Startup Funding

Startup funding is essential for new businesses as it provides the necessary capital to cover initial expenses, scale operations, and invest in growth opportunities. Without adequate funding, many startups may struggle to survive and reach their full potential.

- Angel Investors: Angel investors are individuals who provide capital to startups in exchange for ownership equity or convertible debt. They often offer not just financial support but also valuable advice and connections.

- Venture Capital: Venture capital firms invest in startups with high growth potential in exchange for equity. They typically provide larger amounts of funding compared to angel investors and are actively involved in the management and strategic direction of the startup.

- Crowdfunding: Crowdfunding involves raising funds from a large number of people, usually through online platforms. This method allows startups to access capital from a diverse group of investors and supporters.

Examples of Successful Startups with Funding

- Uber: Uber, the popular ride-sharing service, secured funding from venture capital firms such as Benchmark and Menlo Ventures. This funding helped Uber expand globally and revolutionize the transportation industry.

- Airbnb: Airbnb, the online marketplace for short-term accommodations, raised funds from angel investors like Sequoia Capital and Andreessen Horowitz. This funding enabled Airbnb to scale its platform and disrupt the traditional hospitality sector.

Factors Influencing Startup Valuation

When it comes to valuing a startup for funding, there are several key factors that play a crucial role in determining the overall valuation of the company. These factors can significantly impact how investors perceive the potential of the startup and its future growth prospects.

Market Trends Impact

Market trends have a direct impact on the valuation of a startup. A startup operating in a rapidly growing market with high demand for its product or service is likely to be valued higher than a startup in a declining or saturated market. Investors are more willing to invest in startups that are in industries with promising growth potential.

Significance of Team, Product, and Market Size

The team behind a startup, the uniqueness and quality of its product, and the size of the target market all play crucial roles in determining the valuation of the company. A strong and experienced team inspires confidence in investors, a differentiated and innovative product attracts attention, and a large addressable market indicates significant growth potential.

- The team: Investors look for a team with a diverse skill set, relevant experience, and a track record of success in the industry.

- The product: A unique and high-quality product that solves a real problem for customers can lead to a higher valuation.

- Market size: A large and growing market presents more opportunities for revenue growth and market share, which can positively impact the startup’s valuation.

Examples of Past Influences on Startup Valuations

In the past, we have seen how certain factors have influenced the valuations of startups. For example, companies with disruptive technologies that revolutionized an industry saw their valuations soar due to the potential for massive growth. On the other hand, startups that failed to demonstrate a clear path to profitability or faced strong competition in overcrowded markets often struggled to attract investment at favorable valuations.

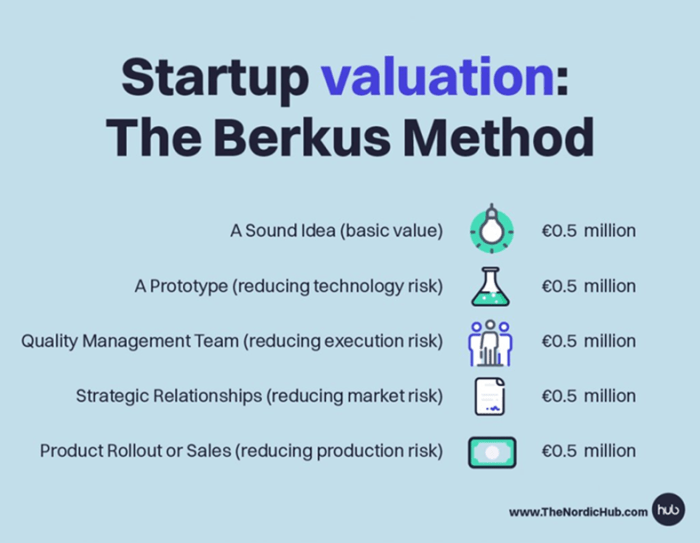

Methods for Valuing a Startup

Valuing a startup is crucial for both investors and founders to determine the worth of the company. There are several methods used to value a startup, each with its own pros and cons. Understanding these methods is essential for making informed decisions regarding funding and investment.

Discounted Cash Flow (DCF) Method

The Discounted Cash Flow method calculates the present value of the future cash flows of a startup. It involves estimating the future cash flows the startup is expected to generate and discounting them back to their present value.

- Pros:

- Provides a comprehensive view of the startup’s potential value based on projected cash flows.

- Accounts for the time value of money, giving more weight to cash flows expected in the near future.

- Cons:

- Requires accurate projections of future cash flows, which can be challenging for early-stage startups.

- Sensitive to changes in discount rates, which can significantly impact the valuation.

Market Comparables Method

The Market Comparables method values a startup by comparing it to similar companies in the market that have been recently funded or acquired. This method uses multiples such as Price-to-Earnings (P/E) ratio or Price-to-Sales (P/S) ratio to determine the valuation.

- Pros:

- Relatively easy to understand and implement, especially for startups with comparable peers.

- Provides a benchmark based on market transactions, giving a sense of the startup’s relative value.

- Cons:

- Dependent on the availability of comparable data, which may be limited for early-stage startups in unique industries.

- Does not account for the startup’s specific growth potential or unique characteristics.

Risk-Factor Summation Method

The Risk-Factor Summation method assesses the various risk factors associated with a startup and assigns weights to each factor to calculate the overall risk-adjusted valuation. Factors such as market risk, technology risk, and competition are considered in this method.

- Pros:

- Takes into account the specific risks associated with the startup, providing a customized valuation based on risk factors.

- Helps investors understand the level of risk involved in investing in the startup.

- Cons:

- Subjective nature of assigning weights to risk factors may lead to varying valuations based on individual perspectives.

- Requires a deep understanding of the startup’s industry and market dynamics to accurately assess risk factors.

Importance of Financial Projections

Financial projections play a crucial role in valuing a startup for funding as they provide potential investors with a glimpse into the future performance and growth potential of the business. These projections are essential for investors to assess the viability of the startup and make informed decisions regarding funding.

Role of Accurate Financial Projections

Accurate financial projections can greatly impact the valuation process of a startup. When financial projections are realistic and based on thorough market research and analysis, they instill confidence in investors about the startup’s ability to generate returns and achieve its milestones.

Tips for Creating Compelling Financial Projections

- Ensure projections are based on solid market research and realistic assumptions.

- Include detailed revenue forecasts, expense projections, and cash flow estimates.

- Use multiple scenarios (optimistic, realistic, pessimistic) to demonstrate flexibility and risk assessment.

- Seek feedback from industry experts or advisors to validate your projections.

- Update and revise your financial projections regularly to reflect changes in the market or business environment.

Success Stories of Startups with Strong Financial Projections

One notable example is Airbnb, which secured funding early on due to its compelling financial projections that showcased a clear path to profitability and scalability. Another success story is Uber, which attracted investors with its robust financial forecasts and growth strategy.

In conclusion, mastering the art of valuing a startup is crucial for its success in securing funding. By considering various factors and adopting effective valuation methods, entrepreneurs can position their ventures for growth and investment.

FAQ Corner

What are the main types of startup funding?

Startup funding can come from angel investors, venture capital firms, or through crowdfunding platforms.

How do market trends influence startup valuation?

Market trends can significantly impact how investors perceive the value of a startup, leading to fluctuations in valuation.

Why are financial projections important for valuing a startup?

Accurate financial projections offer insights into the potential growth and profitability of a startup, influencing its valuation positively.