Starting with How to get startup funding, this introduction aims to grab the readers’ attention with a brief overview of the essential steps and strategies involved in securing funding for new businesses.

It covers the importance of funding, various types of funding options, preparation steps, navigating the funding process, alternative funding strategies, and successful examples to inspire aspiring entrepreneurs.

Importance of Startup Funding

Startup funding plays a crucial role in the success of launching a new business. Without adequate funding, startups may struggle to grow, expand, or even survive in the competitive market.

Impact of Adequate Funding on Startup Success

Having sufficient funding can significantly increase the chances of a startup succeeding. It allows businesses to invest in necessary resources, hire skilled personnel, develop innovative products or services, and market effectively to reach their target audience.

- Proper funding enables startups to scale their operations and enter new markets, increasing their visibility and competitiveness.

- Startups with adequate funding can weather unexpected challenges or setbacks, such as market fluctuations or unforeseen expenses.

- Access to funding also gives startups the flexibility to pivot their business model, adapt to changing consumer preferences, or invest in new technologies to stay ahead of the curve.

Examples of Successful Startups with Proper Funding

Several successful startups have benefited from securing the right funding at the right time, propelling them to growth and profitability.

Uber, Airbnb, and Spotify are prime examples of startups that received significant funding early on, allowing them to disrupt traditional industries and achieve immense success.

These companies were able to innovate, expand globally, and dominate their respective markets due to the financial support they received from investors who believed in their vision and potential.

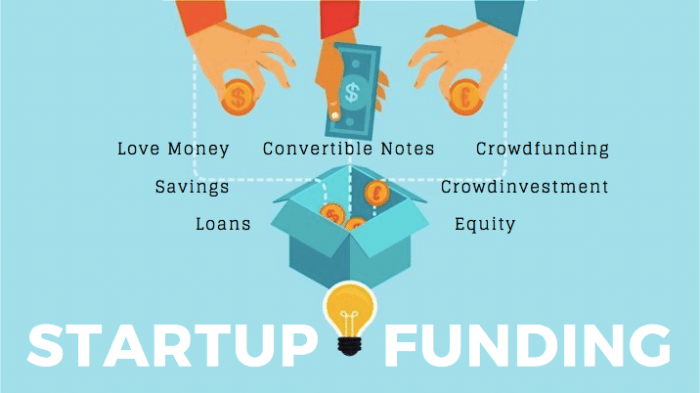

Types of Startup Funding

In the world of startups, securing funding is crucial for growth and success. There are various sources of startup funding, each with its own advantages and disadvantages. Let’s explore the different types of startup funding and when they are most suitable for a startup.

Angel Investors

Angel investors are individuals who provide financial backing for startups in exchange for ownership equity or convertible debt. They often invest in early-stage companies and provide mentorship and guidance along with their investment.

- Advantages:

- Quick decision-making process

- Flexible terms

- Personalized guidance and mentorship

- Disadvantages:

- Limited capital compared to other sources

- Risk of conflicts due to personal involvement

Venture Capital

Venture capital firms invest in startups with high growth potential in exchange for equity. They typically invest larger sums of money in later-stage startups and often require a seat on the board of directors.

- Advantages:

- Significant funding for scaling operations

- Access to valuable networks and resources

- Expertise in scaling businesses

- Disadvantages:

- High equity ownership demands

- Rigorous due diligence process

- Loss of control over decision-making

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms. This type of funding can be rewards-based, equity-based, or donation-based.

- Advantages:

- Access to a wide pool of potential investors

- Validation of product or idea from the market

- Low barrier to entry for startups

- Disadvantages:

- Time-consuming campaign management

- Risks of regulatory compliance issues

- Limited funding amount per investor

How to Prepare for Startup Funding

Before seeking startup funding, entrepreneurs need to take several key steps to increase their chances of success. These steps include creating a solid business plan, developing financial projections, and building a strong pitch deck to attract potential investors.

Importance of a Solid Business Plan and Financial Projections

Having a well-thought-out business plan is crucial when seeking startup funding. Investors want to see a clear roadmap of your business goals, target market, competition analysis, and revenue model. Financial projections are also essential as they demonstrate your understanding of the financial aspects of your business and your ability to generate profits.

- Create a detailed business plan outlining your company’s mission, vision, target market, and unique value proposition.

- Include financial projections such as revenue forecasts, expenses, and cash flow statements to show potential investors the growth potential of your business.

- Consult with financial experts or mentors to ensure your financial projections are realistic and achievable.

Tips for Building a Strong Pitch Deck

A pitch deck is a visual presentation that provides an overview of your business to potential investors. A well-crafted pitch deck can make a lasting impression and increase your chances of securing funding.

- Keep your pitch deck concise and focused, highlighting key information such as market opportunity, business model, competitive advantage, and financial projections.

- Use visuals, charts, and graphs to make your pitch deck visually appealing and easy to understand.

- Practice your pitch and be prepared to answer any questions that investors may have about your business.

Navigating the Funding Process

Navigating the funding process can be a challenging but crucial step for startup founders. Understanding the typical stages involved, identifying the right investors, and negotiating funding terms are essential for securing the necessary resources to grow your business.

Typical Stages in the Startup Funding Process

- Seed Funding: This initial stage involves raising capital to develop a business idea or prototype.

- Series A Funding: Startups at this stage seek funding to scale operations and accelerate growth.

- Series B, C, D Funding: These subsequent rounds of funding help startups expand further and reach new markets.

- Exit Strategy: Planning for a successful exit, such as through an acquisition or IPO, is crucial for investors.

Identifying the Right Investors for Your Startup

- Research: Look for investors who have previously funded startups in your industry or niche.

- Network: Attend industry events, pitch competitions, and investor conferences to connect with potential investors.

- Seek Referrals: Ask fellow entrepreneurs, mentors, or advisors for introductions to investors who align with your business goals.

Strategies for Negotiating Funding Terms and Valuations

- Understand Your Value: Clearly articulate the unique value proposition of your startup to justify your funding requirements.

- Focus on Relationships: Building trust and rapport with investors can lead to more favorable terms during negotiations.

- Consult Experts: Consider hiring legal or financial advisors to help navigate complex terms and ensure a fair deal for your startup.

Alternative Funding Strategies

When traditional startup funding options are not feasible or available, entrepreneurs can turn to alternative funding strategies to finance their ventures. These methods, such as bootstrapping and grants, offer unique opportunities and challenges that can help startups thrive in the competitive market.

Bootstrapping

Bootstrapping involves self-funding the startup using personal savings, credit cards, or revenue generated by the business itself. While it allows founders to maintain full control and ownership, it can limit the growth potential due to the lack of external funding. However, successful bootstrapped startups like Mailchimp and Basecamp have demonstrated that it is possible to build sustainable businesses without relying on external investors.

Grants

Grants provide non-dilutive funding to startups from government agencies, non-profit organizations, or private foundations. These funds do not need to be repaid and can help startups accelerate their growth and development. However, the application process can be competitive and time-consuming, requiring startups to meet specific criteria and demonstrate the impact of their projects. Examples of successful startups that have leveraged grants include Khan Academy and Codecademy.

In conclusion, understanding the nuances of startup funding is crucial for entrepreneurs looking to launch and grow their businesses successfully. By following the tips and insights shared in this guide, you can increase your chances of securing the necessary funding for your startup venture.

General Inquiries

How important is startup funding for new businesses?

Startup funding is crucial as it provides the necessary capital for launching and sustaining a new business, covering expenses like product development, marketing, and operations.

What are some common sources of startup funding?

Common sources include angel investors, venture capital firms, crowdfunding platforms, and bank loans.

How can entrepreneurs attract investors with a strong pitch deck?

Entrepreneurs can create a compelling pitch deck by highlighting the problem their startup solves, showcasing the market opportunity, presenting a solid business model, and demonstrating potential for growth.

Are there any benefits to alternative funding strategies like bootstrapping?

Bootstrapping allows entrepreneurs to maintain full control over their business, avoid debt, and retain profits without diluting ownership.