Embarking on the journey of Seed funding for startups opens doors to innovation and growth, fueling the dreams of budding entrepreneurs with crucial financial support. As we delve into the intricate world of startup funding, the allure of seed funding shines brightly, paving the way for promising ventures to flourish and thrive.

Exploring the nuances of seed funding, from its inception to the pivotal role it plays in the success of startups, unveils a landscape rich with opportunities and challenges waiting to be conquered.

Introduction to Seed Funding for Startups

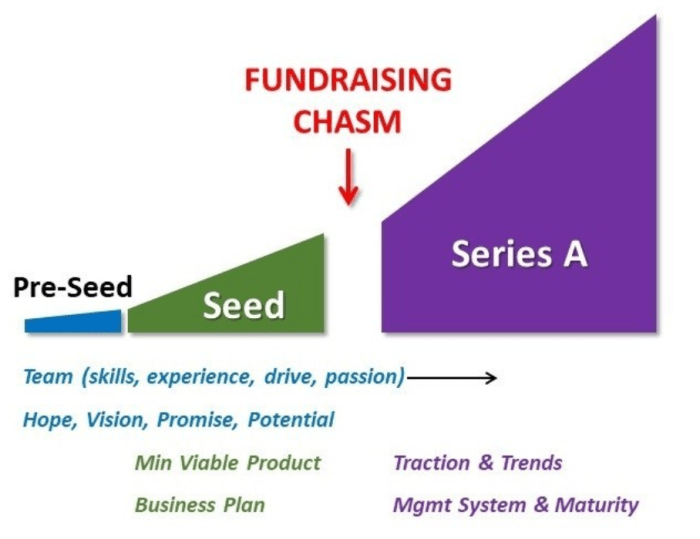

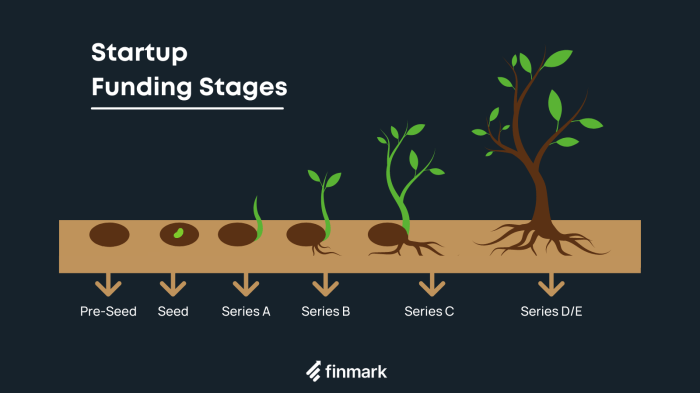

Seed funding is the initial capital raised by a startup to support its early-stage development. It is crucial for startups as it helps them validate their business idea, build a prototype, and attract further investment. Seed funding is usually obtained before a startup reaches the venture capital stage.Typically, seed funding ranges from $50,000 to $2 million, although the amount can vary depending on the startup’s industry, location, and growth potential.

This funding stage is different from other stages like Series A, B, or C, which involve larger amounts of capital and are aimed at scaling the business further.

Primary Sources of Seed Funding for Startups

- Friends and Family: Many startups initially raise seed funding from friends and family who believe in their vision and are willing to invest in the early stages.

- Angel Investors: Angel investors are wealthy individuals who provide capital to startups in exchange for equity. They often have industry experience and can offer valuable mentorship.

- Incubators and Accelerators: These programs provide seed funding, mentorship, and resources to startups in exchange for equity. They help startups accelerate their growth and prepare them for future funding rounds.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow startups to raise seed funding from a large number of individual investors who contribute small amounts of money.

Advantages of Seed Funding

Starting a business can be a daunting task, especially when it comes to securing the necessary funding. Seed funding, however, offers several advantages for startups looking to get off the ground quickly and efficiently.Seed funding provides startups with the initial capital needed to develop their product or service, conduct market research, and build a strong team. This early-stage funding is crucial for startups to validate their business idea and attract further investment.

Flexibility and Control

Seed funding offers startups more flexibility and control compared to other forms of funding, such as venture capital or bank loans. With seed funding, founders can retain a larger ownership stake in their company and make strategic decisions without external interference.

- Founders can focus on building their product or service without the pressure of immediate profitability.

- Seed funding allows startups to experiment and pivot their business model based on market feedback.

- Startups can attract top talent and advisors with the promise of future success and growth.

Successful Examples

Many successful startups have flourished due to seed funding, paving the way for innovation and disruption in various industries. Examples include:

-

Uber:

The ride-sharing giant started with seed funding, which enabled them to expand rapidly and disrupt the traditional taxi industry.

-

Airbnb:

The accommodation marketplace secured seed funding to build its platform and scale globally, revolutionizing the travel industry.

-

Dropbox:

The cloud storage service received seed funding to develop its product and attract millions of users worldwide.

Seed Funding Process

In order to secure seed funding for a startup, there are several key steps that entrepreneurs need to follow. Investors typically look for specific criteria when considering seed funding opportunities, and having a solid business plan is crucial for success.

Steps in Obtaining Seed Funding

- Prepare a compelling business plan outlining the startup’s vision, target market, and financial projections.

- Identify potential investors who specialize in seed funding for startups.

- Pitch your business idea to these investors, highlighting the unique value proposition and potential for growth.

- Negotiate terms and conditions of the seed funding agreement, including equity stake and valuation of the startup.

- Close the deal and use the seed funding to fuel the growth and development of the startup.

Criteria Investors Look For

- Demonstrated market opportunity and potential for scalability.

- Strong founding team with relevant experience and expertise.

- Clear and realistic financial projections and milestones.

- Innovative and differentiated product or service offering.

- Alignment with investor’s investment thesis and goals.

Importance of a Solid Business Plan

Having a solid business plan is essential for securing seed funding as it demonstrates to investors that the startup has a clear roadmap for success. A well-thought-out business plan should Artikel the market opportunity, competitive landscape, revenue model, and growth strategy. It also helps investors assess the startup’s potential for profitability and sustainability in the long run.

Challenges of Seed Funding

Securing seed funding for startups can be a daunting task due to various challenges that entrepreneurs often face. These challenges can impact the success and growth of a startup in the initial stages.

Common Challenges Faced by Startups in Securing Seed Funding

- Lack of track record: Startups often struggle to secure seed funding due to their limited or nonexistent track record in the market.

- Market uncertainty: Investors may be hesitant to invest in startups operating in unproven markets or industries.

- Valuation issues: Determining the valuation of a startup at an early stage can be challenging, leading to disagreements between founders and investors.

Risks Associated with Seed Funding

- Startup risks: Startups face the risk of failure, which can result in loss of investments for seed funders.

- Investor risks: Investors face the risk of investing in startups that may not succeed or generate returns as expected.

- Market risks: External factors such as market fluctuations and competition can pose risks to both startups and investors.

Strategies for Mitigating Risks and Maximizing Potential

- Thorough due diligence: Conducting comprehensive research and analysis before investing can help mitigate risks for both startups and investors.

- Diversification: Investors can reduce risk by diversifying their seed funding portfolio across multiple startups and industries.

- Strong partnerships: Building strategic partnerships and collaborations can help startups navigate challenges and maximize the potential of seed funding.

Startup Funding Options

When it comes to funding options for startups, there are several choices available, each with its own unique characteristics and requirements. In this section, we will compare seed funding with other popular startup funding options such as angel investors, venture capital, and crowdfunding.

Angel Investors

Angel investors are individuals who provide capital for startups in exchange for ownership equity or convertible debt. They typically invest their own money and can offer valuable expertise and connections to the startups they fund.

Venture Capital

Venture capital firms pool money from various sources to invest in startups with high growth potential. They usually invest larger amounts compared to seed funding and often take an active role in the management of the companies they invest in.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms. This option allows startups to reach a wide audience of potential investors and supporters.

Differences in Investment Size, Investor Involvement, and Risk Tolerance

- Investment Size: Seed funding usually involves smaller amounts compared to venture capital, which can provide larger investments. Angel investors may vary in the size of their investments.

- Investor Involvement: Angel investors often provide mentorship and guidance to startups, while venture capitalists may have more direct involvement in the management of the company. Crowdfunding investors may have limited involvement beyond providing financial support.

- Risk Tolerance: Venture capitalists typically have a higher risk tolerance compared to angel investors, who may be more cautious with their investments. Crowdfunding investors may have varying levels of risk tolerance.

Determining the Most Suitable Funding Option

Startups should consider their stage of growth, financial needs, and long-term goals when choosing a funding option. Seed funding may be ideal for early-stage startups looking to validate their ideas, while venture capital may be more suitable for companies ready to scale rapidly. Angel investors can provide valuable support to startups in need of mentorship and guidance, while crowdfunding offers a way to engage a broader community of supporters.

In conclusion, Seed funding for startups serves as a beacon of hope for inventive minds, offering a springboard to transform visions into reality. With careful planning, strategic decision-making, and a dash of courage, startups can navigate the labyrinth of funding options and emerge victorious, carving their path to success in the dynamic realm of entrepreneurship.

Popular Questions

What are the key benefits of seed funding for startups?

Seed funding provides early-stage ventures with essential capital to kickstart their business, access mentorship, and attract further investment.

How can startups mitigate risks associated with seed funding?

Startups can reduce risks by conducting thorough market research, building a strong team, and creating a scalable business model.

What sets seed funding apart from other forms of startup funding?

Seed funding is typically aimed at the initial stages of a startup, focusing on validating ideas and building a prototype, whereas other funding options come into play during later growth phases.