Startup funding trends sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The discussion delves into the various aspects of funding for startups, shedding light on the changing landscape of financial support and the factors influencing these trends.

STARTUP FUNDING

Startup funding refers to the financial support that early-stage companies receive to help them grow and develop their business. This funding is crucial for startups as it allows them to cover initial costs, invest in product development, and scale their operations.

Sources of Startup Funding

- Bootstrapping: Startups use personal savings or revenue generated from the business to fund operations.

- Angel Investors: Individuals who provide capital in exchange for ownership equity or convertible debt.

- Venture Capital: Investment firms that provide funding to startups with high growth potential in exchange for equity.

- Crowdfunding: Platforms where startups can raise funds from a large number of people in exchange for rewards or equity.

- Accelerators and Incubators: Programs that provide funding, mentorship, and resources to startups in exchange for equity.

Importance of Securing Adequate Funding for Startups

Securing adequate funding is crucial for startups to survive and thrive in the competitive business landscape. It allows them to hire talent, develop innovative products, expand their market reach, and ultimately achieve sustainable growth. Without sufficient funding, startups may struggle to scale their operations and realize their full potential.

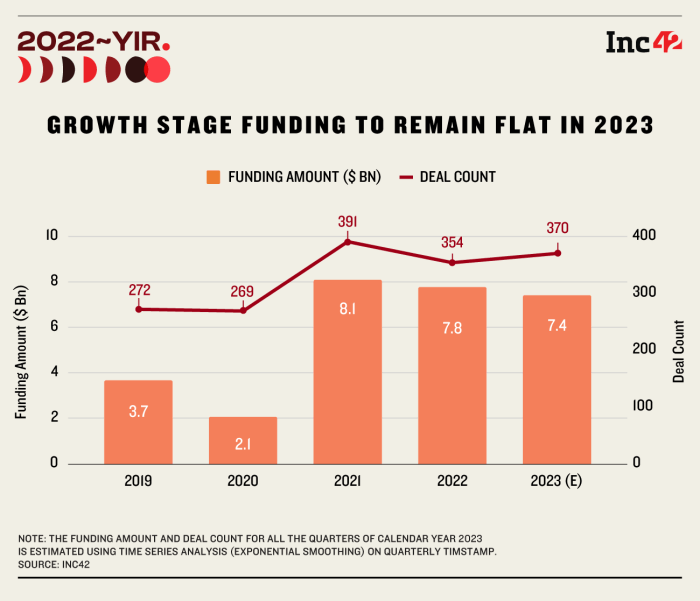

CURRENT TRENDS

Startup funding trends are constantly evolving in response to various factors such as economic conditions, technological advancements, and global events. Understanding the current trends in startup funding is crucial for entrepreneurs seeking financial support for their ventures.

Increasing Emphasis on Diversity and Inclusion

There is a growing awareness and emphasis on diversity and inclusion in startup funding. Investors are more inclined to support businesses led by women, minorities, and underrepresented groups. This shift towards inclusivity aims to create a more equitable and diverse entrepreneurial ecosystem.

Rise of Alternative Funding Sources

Entrepreneurs are exploring alternative funding sources beyond traditional venture capital firms. Crowdfunding platforms, angel investors, accelerators, and corporate partnerships are becoming popular options for startup funding. These alternative sources offer flexibility and diverse funding opportunities for early-stage companies.

Impact of Global Events on Funding Trends

Global events such as the COVID-19 pandemic have significantly influenced startup funding trends. The pandemic has accelerated the adoption of digital technologies and reshaped consumer behavior, leading to increased investment in sectors such as healthcare, e-commerce, and remote work solutions. As a result, investors are reallocating funds to support startups that address emerging market needs and trends.

VENTURE CAPITAL

Venture capital plays a crucial role in startup funding by providing capital to early-stage companies with high growth potential in exchange for equity ownership.

Comparison of Venture Capital Funding with Other Sources

When comparing venture capital funding with other sources such as angel investors or bank loans, venture capital typically involves higher risk but also offers higher potential returns. Venture capitalists often take an active role in the company and provide not just funding but also expertise and valuable connections.

Criteria Considered by Venture Capitalists

- Market Potential: Venture capitalists look for startups operating in large, rapidly growing markets with the potential for significant returns.

- Team: The quality and experience of the founding team are crucial factors considered by venture capitalists as they assess the ability to execute the business plan.

- Technology and Innovation: Startups with innovative technologies or unique business models are more attractive to venture capitalists due to their potential for disruption and scalability.

- Traction: Evidence of market traction, such as customer growth, revenue, or partnerships, is important in demonstrating the startup’s viability and potential for success.

- Exit Strategy: Venture capitalists also consider the potential exit opportunities for their investment, such as acquisition or initial public offering (IPO), to ensure they can realize their returns.

ANGEL INVESTORS

Angel investors play a crucial role in the startup ecosystem by providing early-stage funding to entrepreneurs with innovative ideas. These individuals are typically wealthy individuals who invest their own money in exchange for equity in the startup.

Significance of Angel Investors

- Angel investors fill the gap between friends and family funding and venture capital, providing startups with the necessary capital to launch and grow their businesses.

- They often bring valuable industry experience, connections, and mentorship to the table, helping startups navigate challenges and scale efficiently.

- Angel investors are more willing to take risks compared to traditional investors, allowing startups with high growth potential to receive the funding they need.

Examples of Successful Startups Funded by Angel Investors

- Uber: Angel investor Chris Sacca was an early investor in Uber, providing crucial funding that helped the company expand globally.

- Facebook: PayPal co-founder Peter Thiel was one of the first angel investors in Facebook, playing a key role in the social media giant’s early success.

- Airbnb: Actor Ashton Kutcher and entrepreneur Paul Graham were among the angel investors who supported Airbnb in its early stages, contributing to its rapid growth.

How Startups Can Attract Angel Investors

- Develop a solid business plan outlining the market opportunity, competitive landscape, and growth strategy.

- Build a strong team with relevant experience and a track record of success in the industry.

- Network effectively by attending startup events, pitch competitions, and angel investor meetings to connect with potential investors.

- Show traction and progress by demonstrating early customer acquisition, revenue growth, and product development milestones.

CROWDFUNDING

Crowdfunding is a method of raising capital through the collective effort of a large number of individuals, typically via online platforms. It allows startups to access funding from a wider pool of investors, including friends, family, and the general public, rather than relying on traditional sources like venture capital or angel investors.

Types of Crowdfunding Platforms

- Rewards-based Crowdfunding: Platforms like Kickstarter and Indiegogo allow startups to offer rewards or products in exchange for financial contributions.

- Equity Crowdfunding: Platforms such as SeedInvest and Crowdcube enable investors to receive equity in the startup in exchange for their investment.

- Debt Crowdfunding: Platforms like LendingClub and Funding Circle offer loans to startups, which need to be repaid with interest.

Benefits and Challenges of Crowdfunding

- Benefits:

- Access to a larger pool of potential investors.

- Can generate early market validation and customer feedback.

- Can help build a community around the startup and create brand advocates.

- Challenges:

- Time-consuming to manage the campaign and engage with backers.

- Risk of not reaching funding goals and not receiving any capital.

- Potential for intellectual property theft or idea replication.

ALTERNATIVE FUNDING METHODS

When it comes to funding startups, there are alternative methods besides venture capital and angel investors that entrepreneurs can explore. One such method is bootstrapping, which involves funding the business using personal savings or revenue generated by the business itself.

Bootstrapping as a Funding Strategy

Bootstrapping can be a viable funding strategy for startups, especially in the early stages. One of the main advantages is that it allows entrepreneurs to maintain full control over their business without having to give up equity to investors. Additionally, bootstrapping forces entrepreneurs to be resourceful and creative in managing their finances, which can lead to better financial discipline and decision-making.

- Pros of Bootstrapping:

- Avoid dilution of ownership: Entrepreneurs retain full control over the business.

- Financial discipline: Forces entrepreneurs to make efficient use of resources and focus on revenue generation.

- No pressure from investors: Entrepreneurs can make decisions based on what is best for the business without external influence.

- Cons of Bootstrapping:

- Limited resources: Bootstrapping may limit the growth potential of the business due to lack of external funding.

- Risk of failure: Without external investment, the business may struggle to scale or compete in the market.

- Personal financial risk: Entrepreneurs risk their own savings or assets by funding the business themselves.

Examples of Startups Using Alternative Funding Methods

Several successful startups have used alternative funding methods to grow and scale their businesses. For example, Airbnb initially funded its operations by selling novelty breakfast cereals, while Mailchimp bootstrapped its way to becoming a leading email marketing platform without any external funding. These examples showcase how creativity and resourcefulness can lead to success, even without traditional sources of funding.

In conclusion, the dynamic nature of startup funding trends underscores the importance of adaptability and innovation in securing financial backing for aspiring entrepreneurs. This overview serves as a valuable resource for understanding the intricacies of funding in the ever-evolving startup ecosystem.

FAQ Compilation

How can startups stay informed about the latest funding trends?

Startups can stay informed by regularly following industry publications, attending networking events, and engaging with investors to understand market dynamics.

What role do global events play in shaping current funding trends for startups?

Global events can significantly impact funding trends by influencing investor sentiment, market conditions, and the overall economic landscape, leading to shifts in funding strategies.

What are some alternative funding methods startups can explore besides venture capital and angel investors?

Startups can consider options like grants, loans, accelerators, and incubators as alternative funding sources to diversify their financial support and minimize reliance on traditional funding avenues.